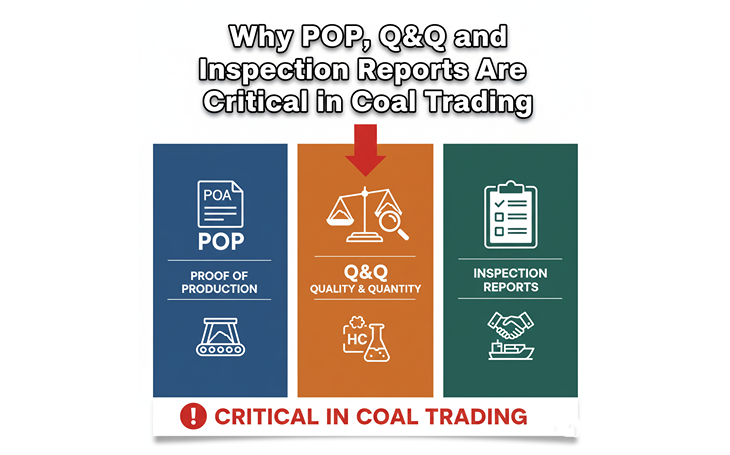

Why POP, Q&Q and Inspection Reports Are Critical in Coal Trading

Coal trading involves large cargo values, long supply chains, and multiple stakeholders across countries. In such a complex environment, disputes often arise not because of price or availability, but due to disagreements over quality, quantity, and delivery conditions. This is where documents like POP, Q&Q, and inspection reports become critical. For coal buyers and sellers, especially in India, these reports are not just formalities. They are essential tools for risk management, payment security, and smooth trade execution.

Understanding POP in Coal Trading

POP, or Proof of Performance, is a set of documents that demonstrate a seller’s ability to supply coal as per agreed terms. It may include past shipment records, contracts, bills of lading, or inspection certificates from earlier deliveries.

For buyers, POP builds confidence in the seller’s credibility and operational capability. In international coal trade, where buyers may not have direct visibility into overseas suppliers, POP helps reduce counterparty risk. Banks and financial institutions also rely on POP before issuing instruments like Letters of Credit or Performance Bonds.

Without reliable POP, buyers risk entering contracts with suppliers who lack the capacity or track record to deliver, leading to delays and financial exposure.

The Role of Q&Q Reports

Q&Q stands for Quality and Quantity. Q&Q reports confirm two of the most important aspects of any coal shipment: whether the coal meets agreed quality specifications and whether the correct quantity has been loaded or discharged.

Quality parameters typically include calorific value, ash, moisture, volatile matter, and sulfur content. Quantity verification ensures that the tonnage loaded matches the contract terms.

Q&Q reports are usually issued by independent inspection agencies at the loading port, discharge port, or both. These reports form the basis for invoicing, payment settlement, and dispute resolution. Any mismatch between declared and actual figures can have serious financial implications.

Why Inspection Reports Matter

Inspection reports provide independent verification of cargo condition, sampling methods, and testing results. In coal trading, inspection reports are often linked to payment milestones and customs clearance.

For buyers, inspection reports protect against receiving off specification coal. For sellers, they provide evidence that cargo was delivered as per contract. Indian customs authorities also rely heavily on inspection reports to verify declared values and quality during import clearance.

In the absence of proper inspection reports, shipments may be delayed, payments may be held, and disputes may escalate into legal or arbitration proceedings.

Impact on Payments and Dispute Resolution

POP, Q&Q, and inspection reports are closely tied to payment security. Under an LC based transaction, banks release payment only when documents comply with agreed terms. Any inconsistency in reports can lead to payment delays or outright rejection.

In case of disputes, these documents serve as primary evidence. Clear and professionally issued reports reduce ambiguity and help resolve issues faster, saving time and cost for both parties.

Common Challenges Faced by Traders

Many coal trades fail due to poorly drafted inspection clauses, inconsistent reporting formats, or reliance on unrecognized agencies. In some cases, buyers receive reports that do not align with Indian regulatory expectations, creating problems during customs clearance.

Managing these risks requires technical understanding and careful coordination between suppliers, inspectors, banks, and authorities.

How Gsinfotechvis Adds Value

Gsinfotechvis helps coal buyers and traders manage POP, Q&Q, and inspection processes with precision. Their team supports document review, inspection coordination, and compliance alignment with Indian regulations.

By partnering with Gsinfotechvis, businesses can ensure that inspection reports are accurate, consistent, and accepted by banks and authorities. This reduces disputes, protects payments, and supports smooth coal imports.

Conclusion

POP, Q&Q, and inspection reports are the backbone of secure coal trading. They protect buyers from quality and quantity risks, support timely payments, and provide strong defense during disputes. In a highly regulated and competitive market, working with experienced partners like Gsinfotechvis helps ensure that every coal transaction is backed by reliable documentation and strong compliance.

Check us out on LinkedIn.