Top 12 Refinery Hubs Producing Raw Sulphur in 2025: What Buyers Should Know

Below are the top refinery regions that matter in 2025 and why they influence the sulphur market.

Ras Tanura is one of the largest refinery complexes on the planet. It operates with advanced desulfurization systems that generate significant volumes of elemental sulphur. Saudi Arabia’s steady upstream supply makes output predictable. This reliability is why many bulk importers look to Saudi refineries when spot markets tighten.

What buyers like

◾ Stable feedstock

◾ Large contractor availability

◾ Strong compliance and export protocols

Abu Dhabi and Fujairah facilities have expanded sulphur output over the last decade. UAE invests heavily in downstream energy processing and logistics infrastructure. Their ports are efficient, which reduces demurrage risk, a major issue in sulphur cargo.

Advantages

◾ Good packaging and loading availability

◾ Lower port congestion compared to many Asian ports

◾ Strong handling standards for hazardous cargo

Kazakhstan is known for its sour crude reserves. Many refineries there run sulphur recovery units that contribute sizeable output. The country is also becoming a hub for export to South Asia and China due to well planned rail and road routes.

Buyer considerations

◾ Slightly longer logistics cycle

◾ Land routes that reduce dependence on busy sea channels

Indonesia has become a preferred source for Asian buyers. Its refinery expansions and proximity to major fertilizer markets make it ideal for bulk sulphur shipments. Many Indian buyers prefer Indonesian supply because of shorter transit times and predictable vessel availability.

Pros

◾ Competitive pricing trends

◾ Favorable geographical advantage

◾ Access to large ports with sulphur handling experience

China has refineries linked to both domestic industries and large export programs. Even when China consumes most of its sulphur internally, its short term releases to the international market can significantly impact price. Due to the size of its industrial base, movements from China often drive global sentiment.

Qatar’s gas processing plants and refineries generate high quality sulphur. Its ports are optimized for bulk chemical exports and have excellent safety protocols. Qatar shipments benefit buyers who want steady supply without dramatic seasonal swings.

Oman continues to scale capacity and positioned itself as an important Gulf sulphur player. Muscat and Sohar refineries maintain strong logistics partnerships, which supports containerized shipments and bagging solutions.

Kuwait has upgraded many of its refinery units, especially desulfurization technologies. These upgrades produce cleaner refinery sulphur that suits fertilizer grade requirements. Kuwait often exports in bulk vessels that support high tonnage buyers.

Despite geopolitical challenges, Russia remains a large sulphur producer due to its refining and gas processing network. Some markets avoid Russian supply due to sanctions or logistical risk. Others use it as a cost effective backup during shortages.

European refineries focus on cleaner fuels. Their desulfurization systems produce sulphur but the volumes are often smaller compared to the Gulf. However, European sulphur is typically well documented, high purity and compliant with strict international standards.

Refineries in the United States and Canada produce sulphur from heavy oil and sour gas. North American exports are not the cheapest, but the supply is dependable and backed by strict quality verification systems.

India has increased its refinery activity and sulphur recovery output, but domestic consumption often absorbs most of it. While India exports, its primary role is as one of the world’s largest sulphur consumers.

Different regions offer different advantages. The right source depends on your market, your tonnage needs and your internal processing system.

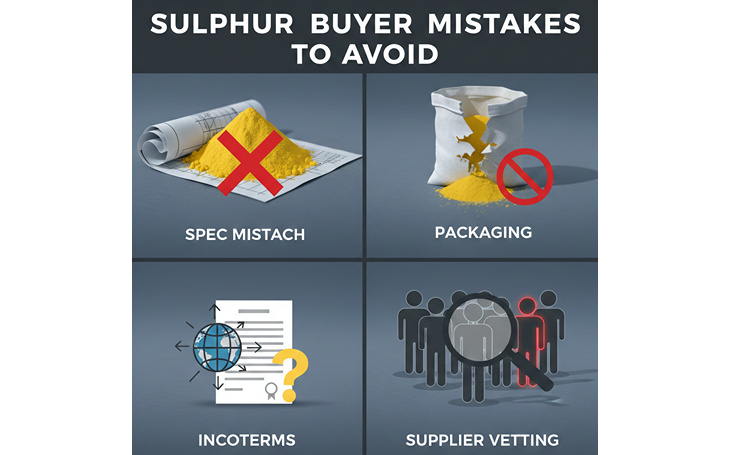

Consider these factors:

◾ Refinery stability and production history

◾ Vessel availability and port conditions

◾ Packaging options such as jumbo bags or bulk

◾ Third party inspection and documentation

◾ Local regulations on hazardous cargo

◾ Transit time relative to your operational window

Refinery grade sulphur from established hubs reduces the risk of contamination and storage loss. Poor quality sulphur can damage furnaces, slow down sulphuric acid production and increase dust exposure for workers.

Gsinfotechvis Pvt Ltd sources raw sulphur from trusted refinery partners across major hubs. Clients benefit from consistent purity, strict documentation and coordinated shipping. Every shipment is supported with inspection reports, MSDS compliance and packaging that protects inventory in transit.

Industrial buyers choose GILS because:

◾ Supply networks cover multiple refinery regions

◾ Quality standards match fertilizer and chemical requirements

◾ Logistics support helps avoid demurrage and customs delays

◾ Packaging options protect cargo during long storage periods

When refinery hubs shift output or pricing, experienced partners act as a buffer. If your business needs dependable sulphur sourcing in a volatile market, Gsinfotechvis Pvt Ltd is ready to support your growth.

Check us out on LinkedIn.